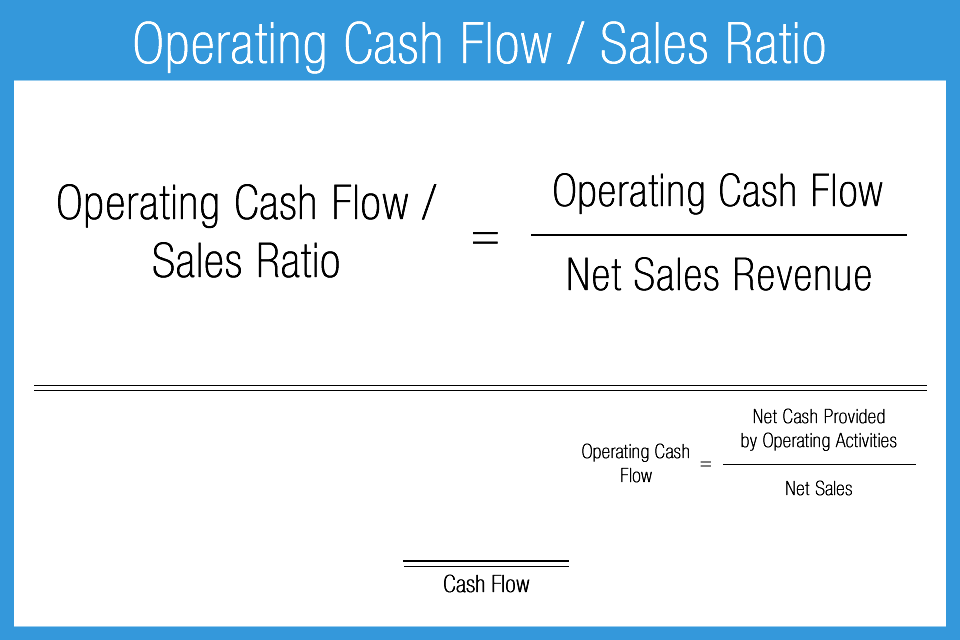

operating cash flow ratio calculator

Here is how the Operating. The operating cash flows of a company YZ Ltd.

Cash Flow From Operations Summary And Forum 12manage

Here is everything you need to know to calculate your businesss operating cash flow margin and track the performance of your company.

. Traditional accounting ratios are often based on the net income of a business. Once cash flow is determined the. Now that we have all the data needed to calculate the operating cash flow margin we can substitute the values for the variables in the formula.

Using operating cash flow using sales revenue and using net operating profits. Enterprise Value Calculator Online. Let us try to understand the concept of cash flow coverage ratio with the help of an example.

The operating cash flow ratio is a measure of how well current liabilities are covered by the cash flow generated from a companys operations. Operating Cash Flow Ratio. Are 50000000 and the total debt.

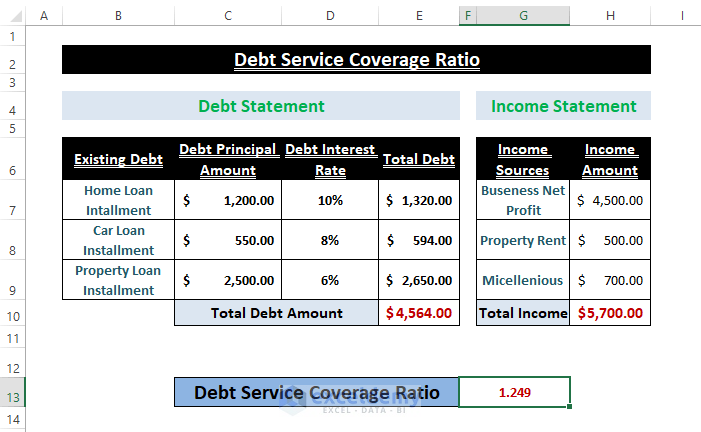

Net sales 5400000. For more information about or to do calculations involving debt-to-income ratios please visit the Debt-to-Income Ratio Calculator. What is the Operating Cash Flow Formula.

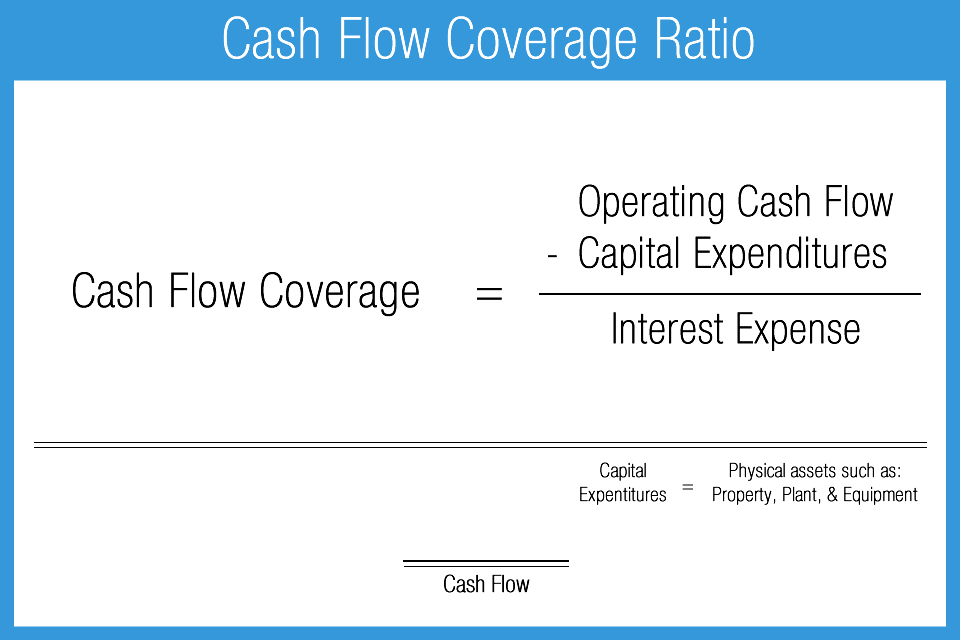

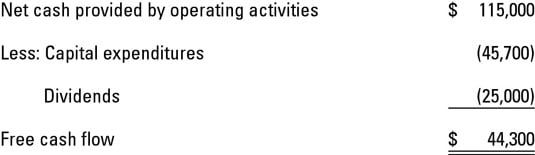

Calculating the free cash flow to sales ratio requires an additional step subtracting capital expenditures from operating cash flow. This article will look at what. Below is an operating cash flow ratio calculator which estimates how many times over a company could pay off current liabilities in a given period using only operating cash flows.

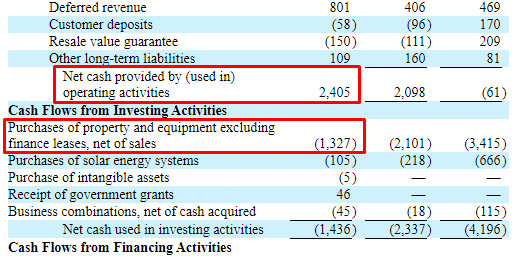

If the ratio is less than 1 the company generated less cash from operations than needed to pay off. The Operating Cash Flow Formula is used to calculate how much cash a company generated or consumed from its operating. Operating Cash Flow Margin.

Operating cash flow OCF ratio is a metric to help understand how liabilities are impacting a business and whether its in the best position to grow. We can calculate operating ratio. Inserting values into the formula 1000 200 - 350.

Terms You Should Know. An operating cash flow margin is a measure of the money a company generates from its core operations per dollar of sales. The operating cash flow ratio measures a companys short-term liquidity.

Operating ratios is the ratio which measures the efficiency of a firms management comparison with operating expense to net sale. To use this online calculator for Operating Cash Flow enter Earnings Before Interest and Taxes EBIT Depreciation D Taxes T and hit the calculate button. There are three ways to calculate free cash flow.

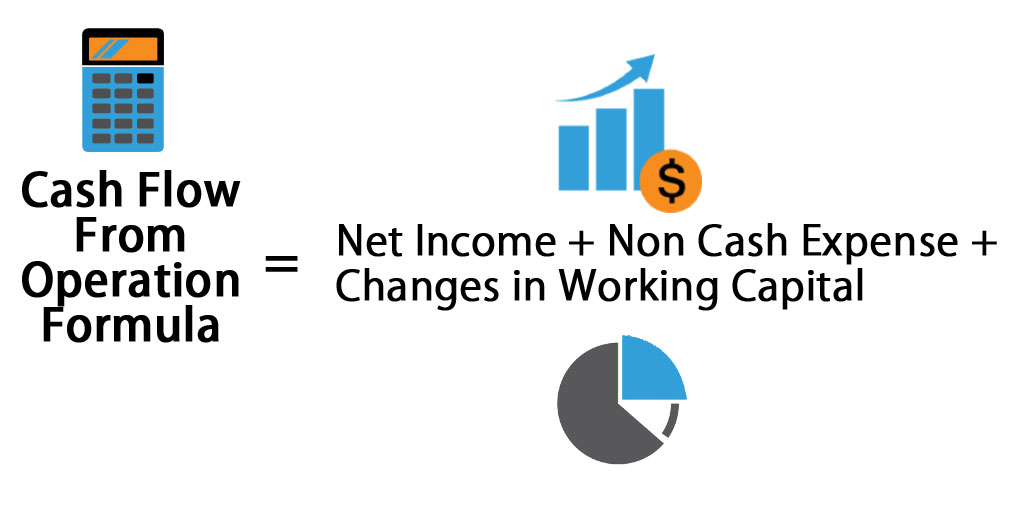

We know the formula to calculate operating cash flow EBIT Depreciation - Taxes. This can be used to quickly estimate the cash flow and profit. How Does Operating Cash Flow Calculator Work.

Free cash flow-to-sales is a performance. How to calculate the free cash flow to sales ratio. In this case we want Cash Flow from Operations or Free Cash Flow which is equal to operating cash flow minus capital expenditures.

Net income is a subjective measure which can be manipulated by accounting assumptions and.

Cash Flow Ratios Accounting Play

Cash Flow From Operations Formula Calculator Excel Template

Operating Cash Flow Overview Formula What Is Operating Cash Flow Video Lesson Transcript Study Com

How To Calculate Cash Flow 3 Cash Flow Formulas Calculations And Examples

Debt Service Coverage Ratio Formula In Excel Exceldemy

Cash Flow From Operations Ratio Formula Examples

Free Cash Flow Calculator Calculator Academy

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statements_Reviewing_Cash_Flow_From_Operations_Oct_2020-02-c2254626b9bb4e8eacbfaf47e4e83784.jpg)

Cash Flow Statements Reviewing Cash Flow From Operations

Operating Cash Flow Ratio Calculator

Operating Cash Flow Formula Examples With Excel Template Calculator

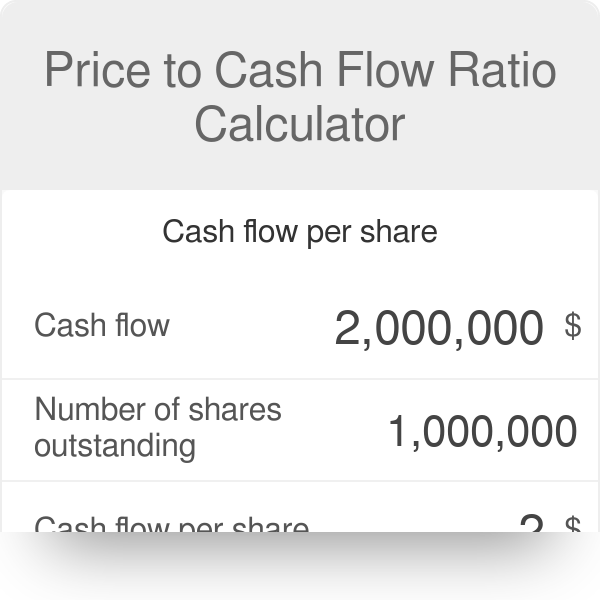

Price To Cash Flow Ratio Calculator Calculate P Cf Ratio

Fiscal Ratio Calculator By Gary Nichols

Free Cash Flow Formula Calculator Excel Template

Operating Cash Flow To Sales Ratio Accounting Play

The 6 Best Metrics And Financial Statements For Your Cash Flow Forecast

How To Calculate Free Cash Flow Dummies

Free Cash Flow To Operating Cash Flow Ratio Accounting Play

Free Cash Flow Fcf Definition Formula And How To Calculate Stock Analysis